If you’ve been searching for a home for some time, you might have a sense of home values in your area.

If you’re working with a real estate agent, he or she will have access to sales prices via their subscription to the local Multiple Listing Service (MLS). What’s more, they can see what homes did not sell, which also indicates potential asking prices that were too high.

Market conditions also play a role. Hot or cold markets can move short-term prices up or down based on current demand. Prices for homes sold a month or two ago may not reflect today’s values. Beware of making lowball offers as they are often roundly rejected.

Loan Approval Or Qualified Letter

You need to attach Pre Approval or Pre Qualified Letter with the offer you submit. It’s good to have Pre-approved letter than pre-qualified letter. You can see more detail in mortgage-pre-qualified-vs-pre-approved

Offer

In Florida, offers should be made in writing, using a “AS IS” Residential Contract For Sale And Purchase. Using a legally-binding sales contract is the smartest way forward. As-Is Contract include and the necessary pieces of information the law requires, such as:

- Legal address of the property

- Purchase price and terms

- Details of the earnest money

- Contingencies

- Closing costs, including prorated taxes that may split between the buyer and seller

- Duration of offer (expiration) and expected closing date

Time is of the essence. We recommend giving sellers 24 hours to answer. A stated time in which they need to respond to your offer helps reduce any gaming so that sellers aren’t sitting around waiting for better offers to come their way. Establish an expectation that you’re not interested in playing games.

Contingencies

Smart real estate offers include contingencies; conditions that must be satisfied before the deal consummates. They also protect your good faith deposit which you can get back if the conditions you stipulate in the purchase contract are not met.

For example, while you may have been pre-approved for a loan, you’ll want to include a contingency that final loan approval must be in place before the deal closes. What’s more, the deal may be contingent upon the home’s appraised value or certain repairs the seller must make.

Here are some common contingencies:

- Final approval for financing

- Appraisals

- Inspections

- Completion of repairs

- Sale of a buyer’s existing home

- Expected move-in date

Escalation Clauses

What if the market is “hot” and sellers receive multiple offers at the same time? There’s a way to deal with that – it’s called an escalation clause. Escalation clauses spell out a willingness for a buyer to pay more than their offer price if other buyers outbid them. Clauses include an incremental bid over the competing offer along with a cap, or maximum amount the buyer will pay under any circumstance.

Here’s how it works:

- Buyer offers $250,000

- or $1,000 more than competing offers,

- not to exceed a $275,000.

Earnest Money / Good Faith Deposit

When you put a written offer on a home, an earnest money deposit typically accompanies it. Earnest money is put down and made in good faith, to indicate to the seller that you are serious about buying the house. Good faith deposits essentially pull the house off the market for any other buyers. The amount of earnest money is typically 1 to 3 percent of the purchase price or whatever is prescribed by local custom. As a buyer it is always good to have minimum earnest money deposit. Even you walk out in between you will not lose much money.

Negotiation

If the offer is reasonable, a seller might accept it immediately. However, some negotiation is likely. Many times, small items like the move-in date needs to be sorted out; nothing that will throw the deal off course.

Conversely, the offer may be rejected, or the seller comes back with a counter offer. The number of times offers and counteroffers go back and forth between buyers and sellers has no limit, but rarely does this get out of hand.

Here’s a breakdown:

- You make an offer

- Offer is accepted, rejected or countered by seller

- In the case of a counter offer made to you, you can accept, reject or keep the ball in the air by countering again

- Counter offers can go back and forth as many times as it takes until there is an acceptance or final rejection

When the buyer and seller have accepted the price and terms of a As Is Residential contract, but contingencies remain (very common), the status of the deal is considered “active under contract.” At this point, it is more likely than not that the deal goes through. However, some the remaining items below can still jeopardize the outcome.

THE OFFER IS ACCEPTED! NOW WHAT?

Here’s what happens after your offer is accepted – the remaining steps carried out in the final phase of the home buying process.

Inspections

Inspections reveal the condition of the home, not the value of it. Inspections are not required unless VA or FHA loans are used. However, inspections are highly recommended as they can reveal flaws not easily identified by sight. You’ll feel better about buying a home that is in good condition where the plumbing, electrical systems and foundation (to name a few) perform as expected. It is good to have the inspection after contract signed. Your real estate agent will guide you on this. Your offer might have mentioned the days for inspection period. If any major Issues find on the instruction you can walkout with your earnest money. In other way you can negotiate the price based on inspection result or can ask for any warranty.

Even for new construction homes, inspections are a good idea. Inspectors will look for shoddy workmanship, incomplete work, or anything not built to code.

Appraisals

An appraiser will visit the house and determine what it’s worth. Why does this matter? For home buyers that use financing (as most do), it’s important to know that lenders will not make loans in amounts that exceed the fair market value of the home. Buyers can pay more than the appraised value, but they will have to come up with the difference – in cash – between the purchase price and the loan amount.

Example:

- $300k proposed purchase price

- $280k approved loan amount

- $265k appraisal

- Result: Bank will not lend more than the fair market value of the property

What’s more, loan program guidelines state a maximum loan to value (LTV) ratio. Some programs allow ratios as high as 97%, but let’s look at an example of similar transaction where a conventional loan, with a cap of 80% LTV, is used.

Example:

- $500k proposed purchase price

- $400k approved loan amount ($100k down payment, 80 LTV)

- $475k appraised value (84 LTV)

- Result: Loan to value exceeds 80% maximum, the buyer would need to bring $120k to closing because the new maximum loan amount is $380k

These are two reasons why low appraisals can make deals go sideways, if not die altogether.

Legal Disclosures

The law requires that home buyers receive a certain number of disclosures that itemize any material facts that could affect their decision move forward with the deal. Each state has a certain number of required disclosure forms.

Here are some potential issues that may arise:

- Defects like mold, leaky roof, lead-based paint

- Pest infestation – damages to wood caused by termites or carpenter ants

- Natural hazards – seismic hazard zones, flood zones, fire risk

- Seller Property Discloser – Known facts bout the house

- Lead Based paint addendum ( Prior to 1978)

- HOA disclosure (if required)

- Condo rider (only for condo)

What’s more, sellers must divulge any known defects via a legal document called a Seller Property Discloser.

Title Report

Escrow companies will pull a title report showing the ownership history of the subject property and any encumbrances placed upon it such as liens. Title reports identify anything that would prevent you from owning the home free and clear when the deal closes and ensures that the seller owns the home and has the legal right to transfer title.

Lender Docs

Assuming you were already pre-approved for a mortgage, your lender’s underwriting team will take a final look before giving the “thumbs up” to proceed, known as “clear to close.” Your credit report is pulled again to make sure no new debts have been taken on since the initial approval.

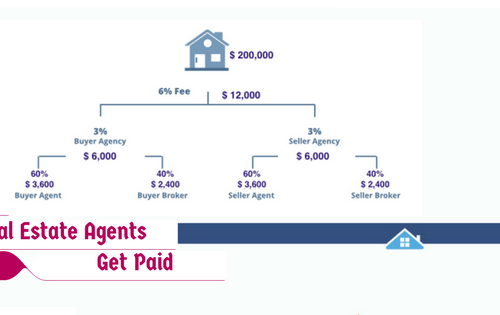

A Closing Disclosure (formerly the HUD-1 Settlement Statement) is drafted showing all the transaction fees and impounds (like pre-paid taxes) down to the penny. If the final Loan to Value (LTV) is less than 80, mortgage insurance is ordered.

Order Insurance

Hazard insurance will also be ordered at this stage. Here’s why. Houses securitize (back) a mortgage. As the underlying asset, lenders want to protect the value of the property in case something goes wrong. Thus, lenders will require insurance coverage.

Depending upon the location of the property, flood and earthquake insurance may also be required.

Home warranties, which typically cover major systems (heating, cooling, plumbing) and appliances are not mandatory. However, many buyers choose to purchase a warranty to prevent unexpected out-of-pocket expenses.

Final Walkthrough

You’ll have the opportunity to make a final walk-through of the home before taking possession of it. Walk-throughs are not required, but recommended, to make sure nothing about the house has changed since the last time you viewed it. You have the right to review any agreed-upon repairs or double-check appliances, windows, plumbing, heating, air conditioning, etc.

Contingency Removal

If there were contingencies included in the purchase contract, the satisfaction of them would have also been specified in the AS-IS Contract. Many common contingencies would be completed as a matter of routine, such as a home inspection, appraisal, final loan approval, etc. With contingencies removed, the status of the home changes to ‘pending.’ The only left to do is finalize the deal at closing.

Closing

This is it, the moment for which you’ve been waiting. Closings typically take place at the offices of a title company and sometimes an attorney’s office. Just a heads up: there’s lots of paperwork. You’ll sign so many documents that your hand and wrist may be cramped when finished.

After the signing ceremony, down payment funds will be transferred (less the earnest money you’ve already committed) from your bank to the escrow company.