Who pays a real estate agent is a very common question.

how are real estate agents compensated for their work? Here’s a brief overview on how real estate agents get paid. To understand who pays real estate commissions — whether it’s sellers or buyers or both — first take a look at how real estate agents are paid and how they share cooperating commissions.

Real Estate Commissions

Most real estate agents make money through commissions – payments made directly to real estate brokers for services rendered in the sale or purchase of real property. A commission is usually a percentage of the property’s selling price, although it can be a flat fee. To understand how real estate agents are paid, it helps to know about the relationship between an agent and a broker. Both agents and brokers are licensed by the state in which they work.

- Real estate agents work for a real estate broker.

- All fees paid to a real estate agent pass through the broker.

- Only a real estate broker can pay a real estate commission and sign a listing agreement with a seller.

The broker’s compensation is specified in the listing agreement, a contract between a seller and the listing broker detailing the conditions of the listing. The rate of the broker’s commission is negotiable in every case; in fact, it is a violation of federal antitrust laws for members of the profession to attempt, however subtly, to impose uniform commission rates. Commissions are taken out of the sale proceeds, and it’s usually the seller who pays the commission, unless the buyer and seller negotiate a split. Most sellers factor the commission into the asking price, so it can be argued that the buyer pays at least some of the commission in either case (due to the higher asking price).

Sharing Commissions

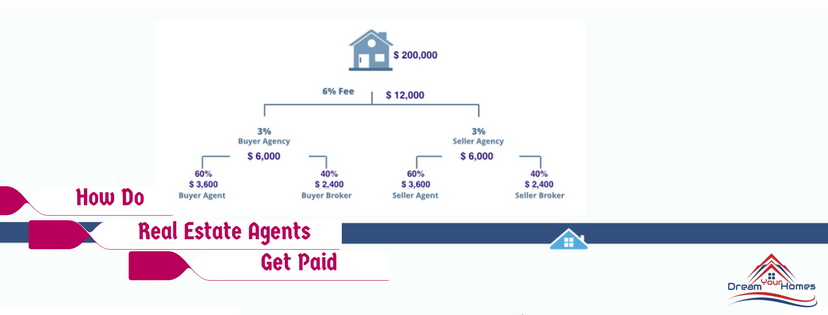

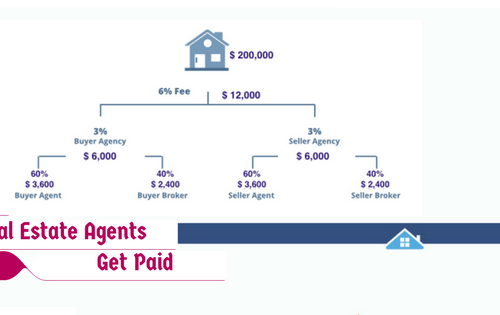

Real estate commissions are often shared among many people. In a typical real estate transaction, the commission might be split four ways, among the:

- Listing agent – the agent who took the listing from a seller

- Listing broker – the broker for whom the listing agent works

- Buyer’s agent – the agent who represents the buyer

- Buyer’s agent’s broker – the broker for whom the buyer’s agent works:

To illustrate, let’s assume an agent takes a listing on a $200,000 house at a 6% commission rate. The house sells for the asking price, and the listing broker and the buyer’s agent’s broker each get half of the commission, or $6,000 each ($200,000 sales price x 0.06 commission ÷ 2). The brokers then split the commissions with the agents. A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio the agent and broker have agreed upon. In a 60/40 split, each agent in our example would receive $3,600 ($6,000 X 0.06), and each broker would keep $2,400 ($6,000 X 0.04).

The final commission breakdown would be:

- Listing agent – $3,600

- Listing broker – $2,400

- Buyer’s agent – $3,600

- Buyer’s agent’s broker – $2,400

Co-Brokerage Splits

Divisions of fees among brokers are not always fair or equal, just like life. For example, a seller could sign a listing agreement for seven apples that stipulates the listing broker will receive four apples and will co-broker three apples to the selling broker.

It’s not always a 50/50 split. In a buyer’s market, sellers might want to consider asking the broker to give a larger percentage to the buyer’s broker. In a seller’s market, the buyer’s broker might receive less. There is no set formula.

Most divisions of the commission are locally based. In some parts of the country, it is very common for a listing agent to make more than the buyer’s agent. Be sure to ask about your local custom. The problem with co-brokerage fees is not necessarily whether to pay more to the buyer’s agent than it is to make sure buyer’s agents are not paid less than the local custom.

Listing Agents / Brokers

Legally speaking, only brokers can list homes. So, while you may work with a listing agent and agree to the terms of the deal, their broker legally holds the listing. What’s more, all commissions flow through brokers, on both the buy side and sell side of the transaction. This isn’t super important to know, as a consumer, but it’s something most people don’t know and it’s somewhat interesting.

Listing agents represent their customers (sellers). Their typical fee is 5 to 6% to list and market a home. Prices are negotiable and vary by market based on local custom. It’s illegal for real estate agents and brokers to collude and fix listing fees; that’s a violation of antitrust laws.

Some discount brokers and for sale by owner (FSBO) companies agree to be paid less than the local norm for listing a home. However, low listing fees can be problematic as there is very little commission left over to split with buyers’ agents. What’s more, with less money on the table, discount brokers are less likely to spend what is required for professional photography, advertising and the myriad of other expenses needed for properly marketing and selling a home.

So just how are homes marketed? Marketing and advertising budgets are deployed the following ways.

Advertising

- Print publications like newspapers and specialty publications

- Personal website

- Office website

- International syndication (especially for luxury properties)

- Billboards

- Internet advertising

- Direct mail

- Yard signs

- Mailers

- Premium placement on real estate portals

- Television

- Social media

- Directories

- Telemarketing

- Flyers

- Yard signs

Marketing

• Local MLS (annual membership fees)

• Property photographs

• Video

• Copywriting

• Open houses

• Home staging

Buyer’s Agents

As explained above, agents who represent buyers get paid a portion of the proceeds of the listing fee. Buyer’s agents incur marketing and advertising expense, too; all agents need to spend money on advertising to gain market share, attract customers and increase awareness of their brands.

No Settlement Can Equal No Pay

In general, commissions are paid only when a transaction settles. There are instances, however, when a seller is technically liable for the broker’s commission even if the transaction is not closed. If the broker has an offer from a ready, willing and able buyer, the broker may still be entitled to a commission if the seller:

- Has changed his/her mind and refuses to sell,

- Has a spouse who has refused to sign the deed (if that spouse had signed the listing agreement),

- Has a title that contains uncorrected defects,

- Commits fraud in regard to the transaction,

- Cannot deliver possession to the buyer within a reasonable time,

- Insists on terms that were not in the listing agreement, or

- Has mutually agreed with the buyer to cancel their transaction.

In some cases, real estate agents are employed by their broker and paid a salary. Redfin.com, for example, is an online property search site that employs a staff of full-service real estate agents who are paid a salary plus a commission dependent upon customer satisfaction ratings collected by the company. It is far more common, however, for agents to be paid a percentage of the commission.

The Bottom Line

Most real estate agents make money through commissions paid directly to brokers when transactions are settled. A single commission is often split multiple ways among the listing agent and broker, and the buyer’s agent and broker. The commission split a particular agent receives depends on the agreement the agent has with his or her sponsoring broker.

for more details, original Source https://www.rubyhome.com/blog/